The global economy is currently experiencing a surge in raw material prices, particularly oil, which has seen a 10% increase over the past two months. This sudden spike in prices has been attributed to a number of factors, including short-term chaos and long-term uncertainties.

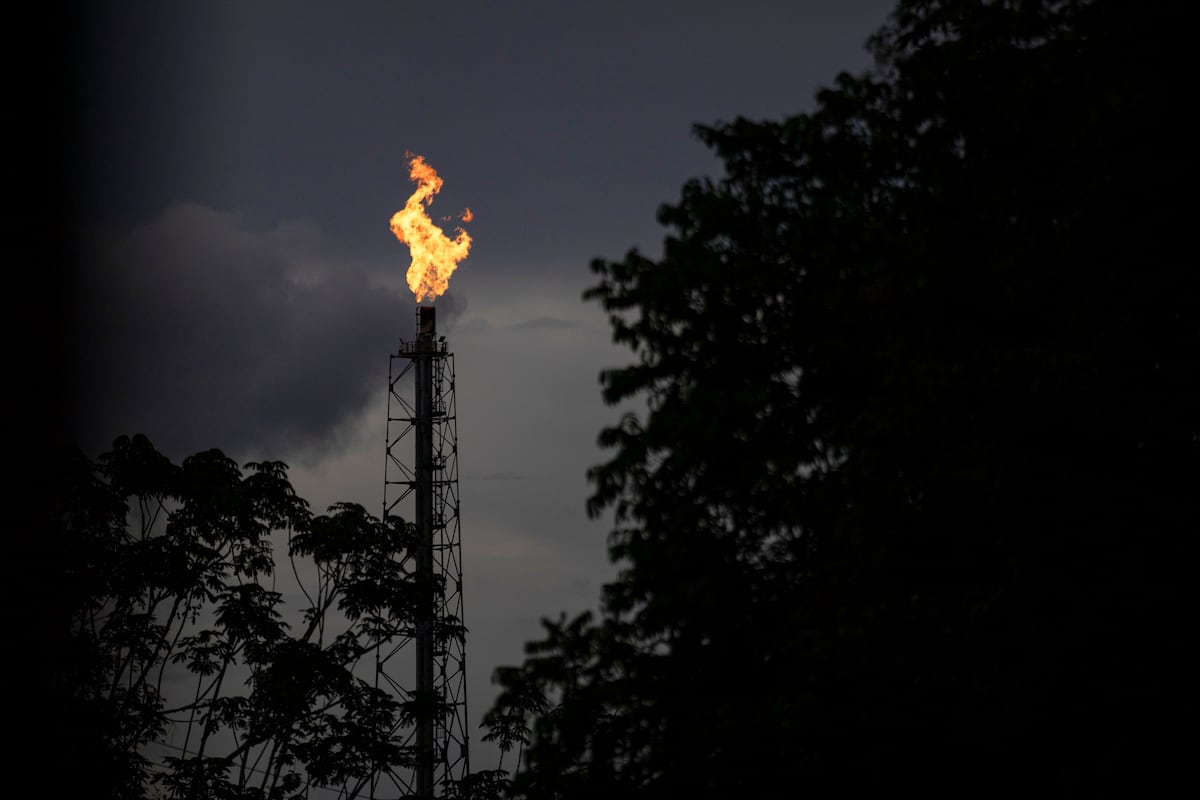

OPEC+’s decision to maintain crude oil production cuts until next June has had an impact on the market, as have Russia’s drone attacks on its refining infrastructure and China’s reduction of oil imports in the first quarter. Additionally, tensions between Israel and Iran have added to the uncertainty in the oil market.

The Strait of Bab el-Mandeb and the Strait of Hormuz are both crucial routes for global oil transportation, and any disruption in these areas could have a significant impact on global oil prices. With concerns about stability in both straits, analysts predict high price volatility for the rest of the year.

Investments in the oil sector have decreased due to expectations of lower demand in the future. However, with uncertainties about future investments and energy policies, prices are expected to remain relatively high. The combination of short-term chaos and long-term uncertainty presents a challenging outlook for the energy sector.

Meanwhile, other content such as sunglasses price comparisons and unrelated articles and videos is also available online.