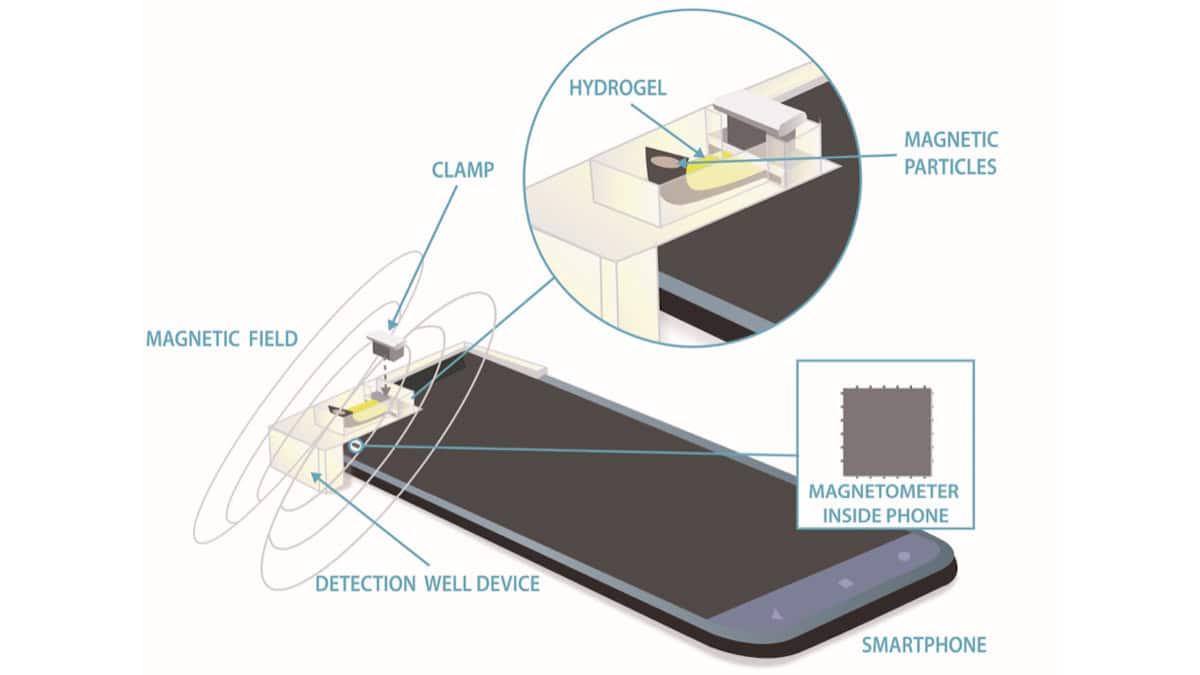

NIST researchers have developed a magnetics-based analyte sensor that shows promising results in detecting...

San Diegans are encouraged to participate in the annual San Diego NAMI Walks and...

On April 24, criminal proceedings were initiated in connection with the intentional disruption of...

Public shootings have been on the rise throughout the region, leaving many individuals struggling...

The annual San Diego NAMI Walks and Mental Wellness Expo will take place this...

The recent decision to overturn Harvey Weinstein’s rape conviction has sparked a new chapter...

In California, the Canyon Club microbrewery restaurant was buzzing with excitement on July 4,...

In Meridian, Mississippi, Ochsner Rush Health and the Mississippi Organ Recovery Agency came together...

Wall Street’s key stock indexes opened lower on Thursday after news of Meta’s significant...

Downtown Fort Myers is a bustling hub for commerce and entertainment, but some business...