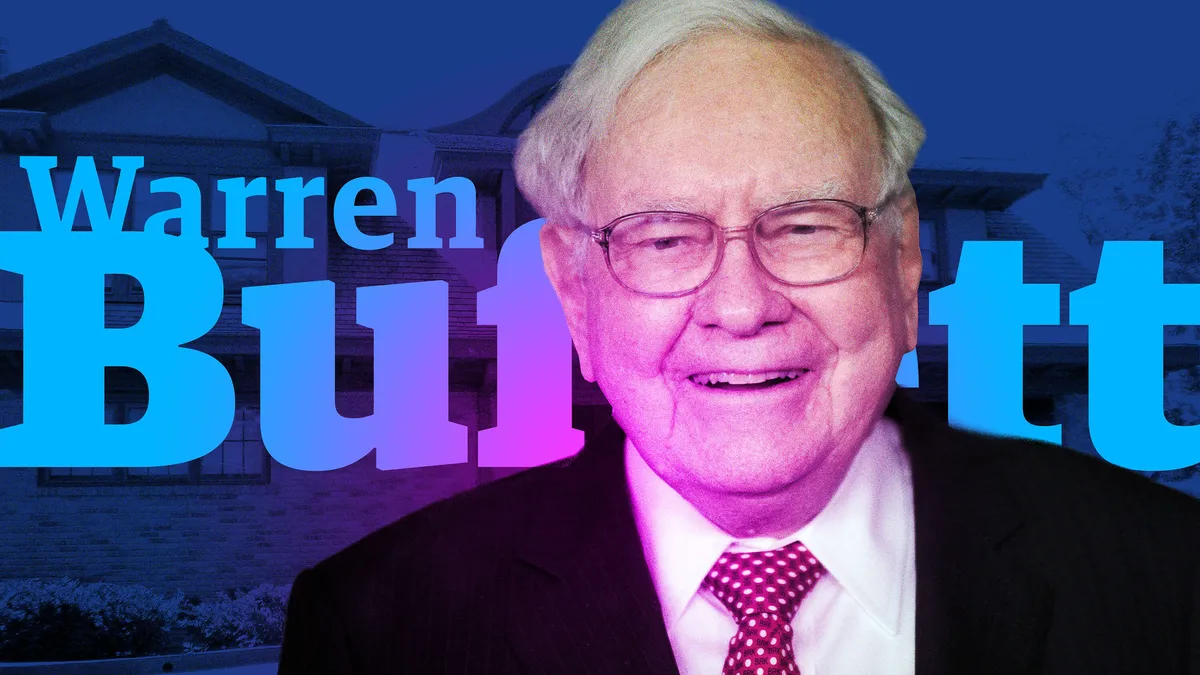

Berkshire Hathaway, the investment company founded by Warren Buffett, reported a robust first quarter result with a 39 percent increase in operating profit to $11.22 billion. The growth was primarily driven by the performance of the insurance business, which saw a substantial increase in underwriting results and investment income. Despite recent acquisitions, such as an insurance company and shares in Occidental Petroleum, Buffett still holds massive cash reserves.

Berkshire Hathaway bought back its own shares worth $2.6 billion during the first quarter due to a lack of suitable acquisition targets. However, Buffett’s reduced holdings in Apple during this period did not significantly impact Berkshire’s financial position. Nicknamed the “Oracle of Omaha,” Buffett’s investment company has consistently grown its cash reserves quarter after quarter, reaching a record $189 billion in the January–March period.

Buffett’s investment company’s cash reserves have been instrumental in Berkshire’s success as it allows the company to take advantage of opportunities that may arise in the future. Despite recent non-recurring entries that led to a 64 percent decrease in first-quarter net profit compared to the previous year, Berkshire Hathaway remains financially strong and well-positioned for long-term success.