On Thursday, manufacturers from across the region gathered in Upper Macungie Township, Lehigh County...

The Finnish beverage industry is hoping for a different outcome as the European Parliament...

In a major victory for Harvey Weinstein and the MeToo movement, the New York...

Launching a “New Beginning”: China’s Shenzhou-18 Mission to Tiangong Space Station Aims for the Moon

The upcoming Shenzhou-18 mission, announced by China, will see three astronauts sent to the...

The 2024 NFL Draft is almost here and we are excited to bring you...

Ford’s Model e electric vehicle segment faced a loss of 1.3 billion USD in...

The tragic drowning of five migrants in the English Channel, including a child, has...

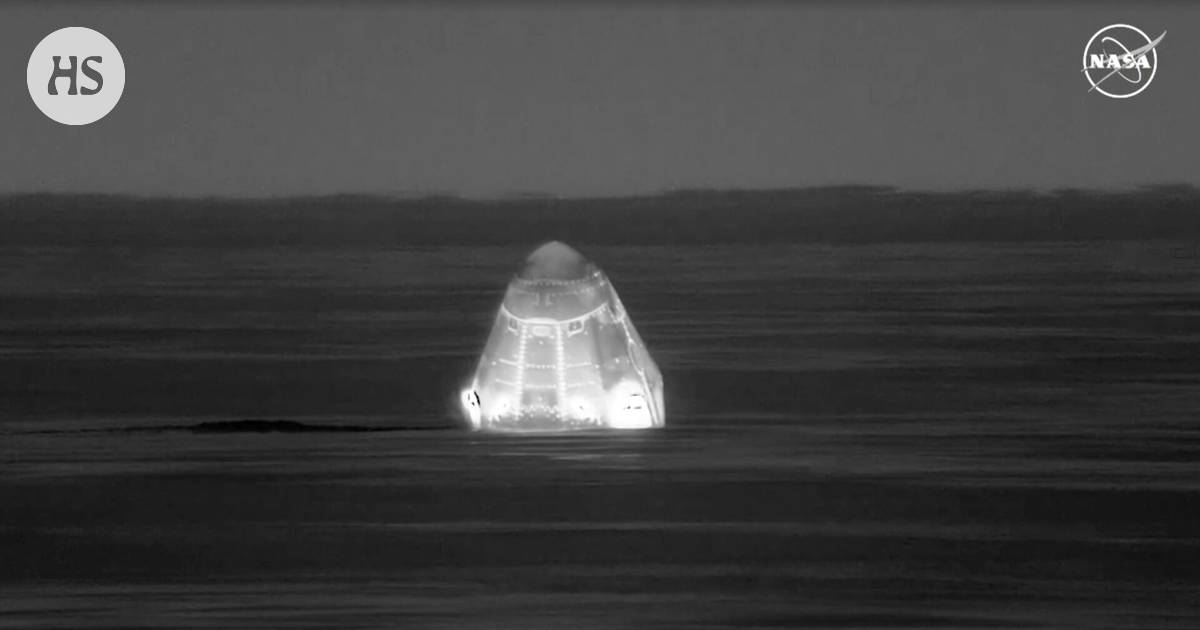

Recently, a team of three astronauts and one cosmonaut completed a six-month mission in...

Kim Petras, the 31-year-old singer who made history as the first openly trans person...

Despite the challenges posed by a slowing economy and persistent inflation, CNBC’s Jim Cramer...

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/YJ5XUJKFIFFWLDXY7YCHSWNHBQ.jpg)