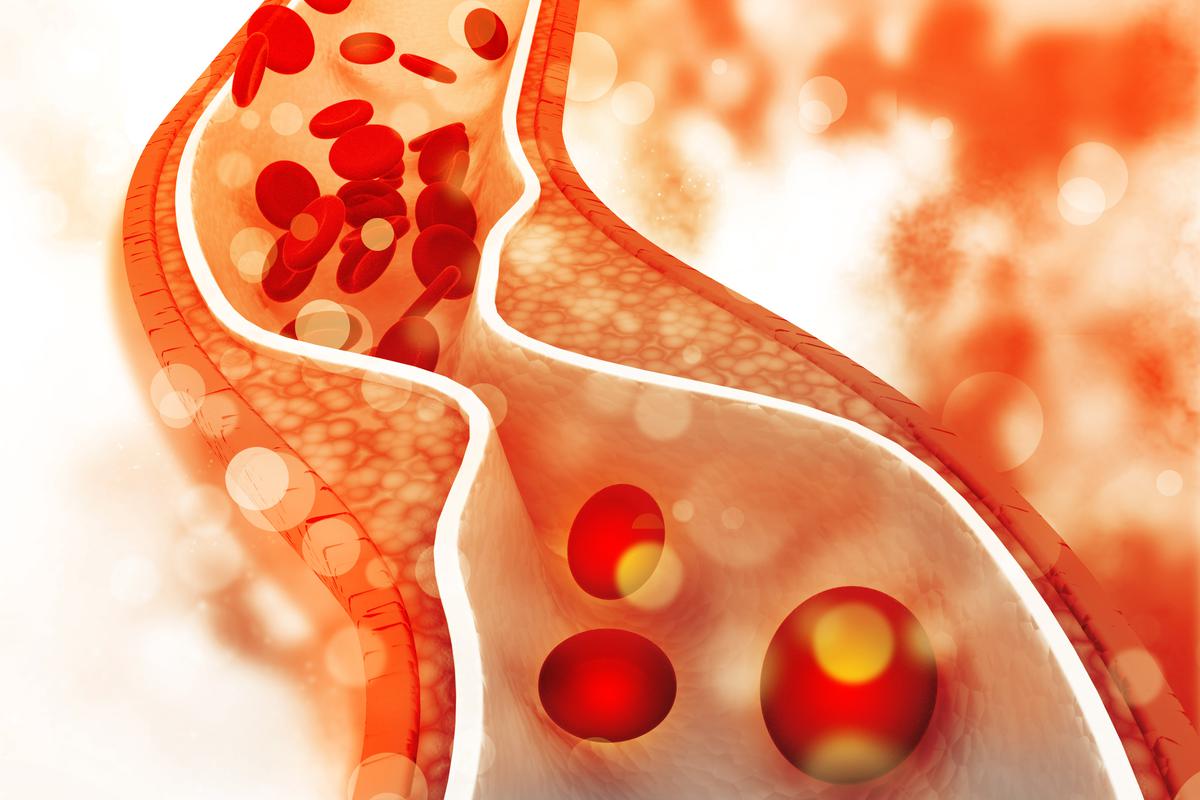

Cholesterol is a type of sterol, specifically a zoosterol found in animals, with the...

Jamestown’s Ella Propheter and her teammates celebrated their victory against West Seneca West during...

In 2023, a treatment facility proposal was rejected by Washington County officials. The Eaglecrest...

In this series, we delve deeper into DeLaval’s cutting-edge VMS Solutions Technology, commonly known...

Stanford University’s former president, John Hennessy, has been named the recipient of the prestigious...

In Bozeman, the Gallatin City-County Health Department (GCCHHD) ordered the closure of Dave’s Sushi...

In 2023, a treatment facility proposal for the Eaglecrest Recovery facility near Beaver Lake...

Join us for a special fireside chat on Universal Health Coverage (UHC) as we...

In the picturesque town of Bariloche, the Llao Llao Forum brings together influential businessmen...

Last month, the Chinese government ordered Apple to remove WhatsApp and Threads from its...