The Xpeng G9 has recently caught the attention of many onlookers at a mall...

On Saturday, New Ulm baseball was victorious against Worthington. Luke Suess played a pivotal...

The first group of employees at Van Hool’s trailer division is expected to return...

On April 19, 2024, a pilot study published in the Journal of Neurosurgery: Spine...

A recent study by ACCA and IMA reveals that finance professionals are feeling optimistic...

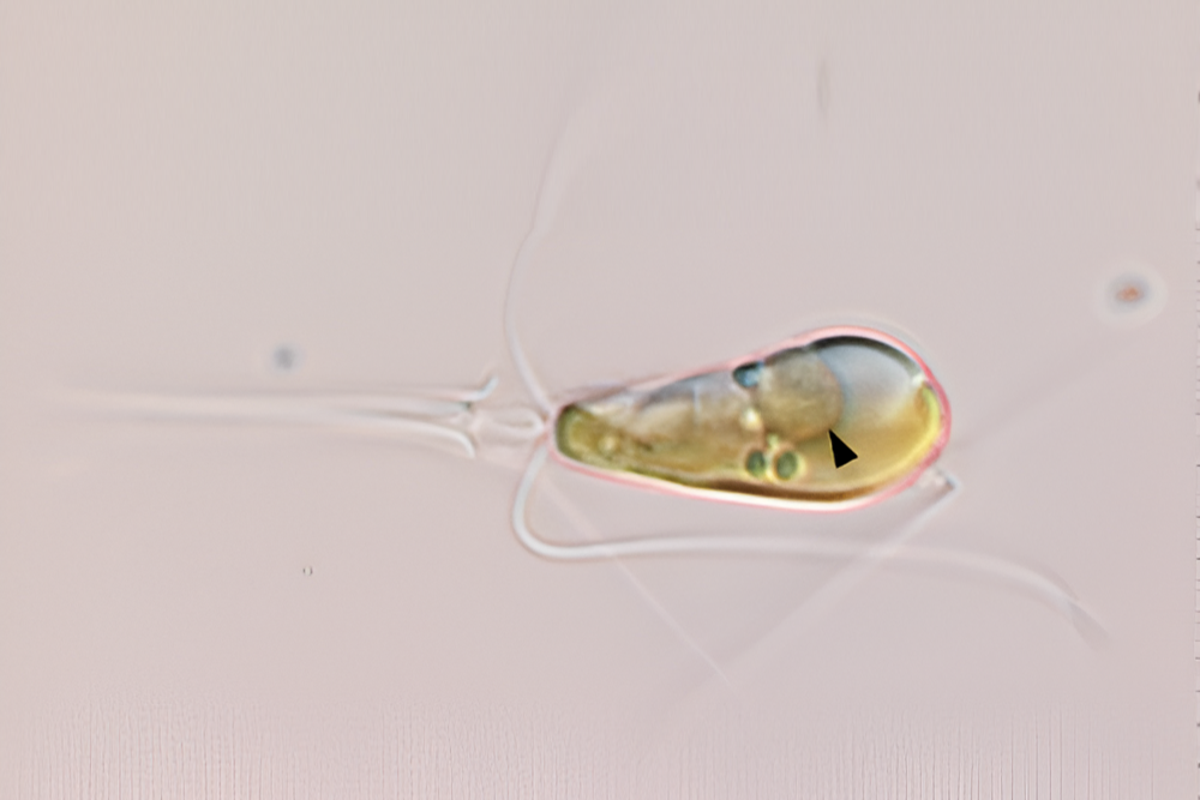

In a groundbreaking evolutionary event, two lifeforms have merged to form a single organism...

German politicians and business leaders are increasingly discussing a topic that was previously considered...

In the first quarter, LG Electronics’ TV business returned to profitability thanks to the...

In Miami Township, the use of drones has been a game changer in enhancing...

Licking Heights Local Schools has received an investment from the Governor’s Office of Workforce...