Nearly 34,200 people have died in the Israeli offensive against the Palestinian enclave of...

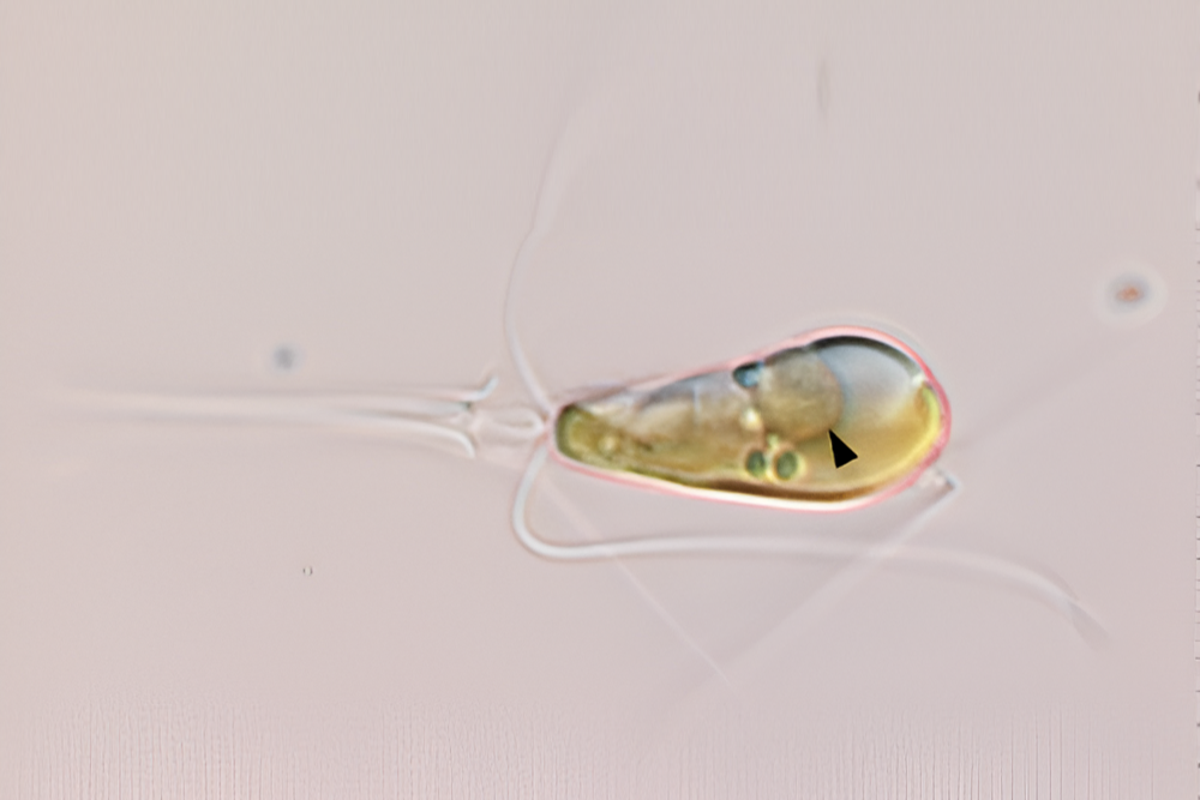

William Gray, an NC A&T student, has been working in a lab where he...

The climate emergency is having a profound impact on our planet and ecosystems, as...

Subscribe to our Voices Dispatches email to receive a comprehensive round-up of the best...

An incident over the weekend at Six Flags Great Escape Lodge & Indoor Waterpark...

The C Institute is hosting the World Sustainability Summit on April 25 and 26...

INVL Technology, a closed-end investment company listed on the Nasdaq Vilnius stock exchange, had...

On April 26, from 5-7 p.m., the Whitefish Lake Institute will be hosting the...

Contributing to a Health FSA can result in significant tax savings. By deducting your...

The real estate market in Sioux Falls is expanding, presenting opportunities and challenges for...