This week, the Beatrice High School science club is hosting its annual spring sale....

The 2024 World Beer Cup, held on April 24th at The Venetian Las Vegas,...

On Wednesday night in downtown Boston, leaders from the life sciences community gathered to...

In recent years, Texas has seen a steady growth of its working population, with...

FunCycled, a local family-owned business in Wynantskill, began as a flipping company in 2021...

The annual World’s Biggest Fish Fry returned to Paris, Tennessee on April 20th, with...

The 14th Annual Meeting of Becker’s featured a panel discussion on the challenges of...

Governor Greg Abbott expressed his pride in Texas being named the best state for...

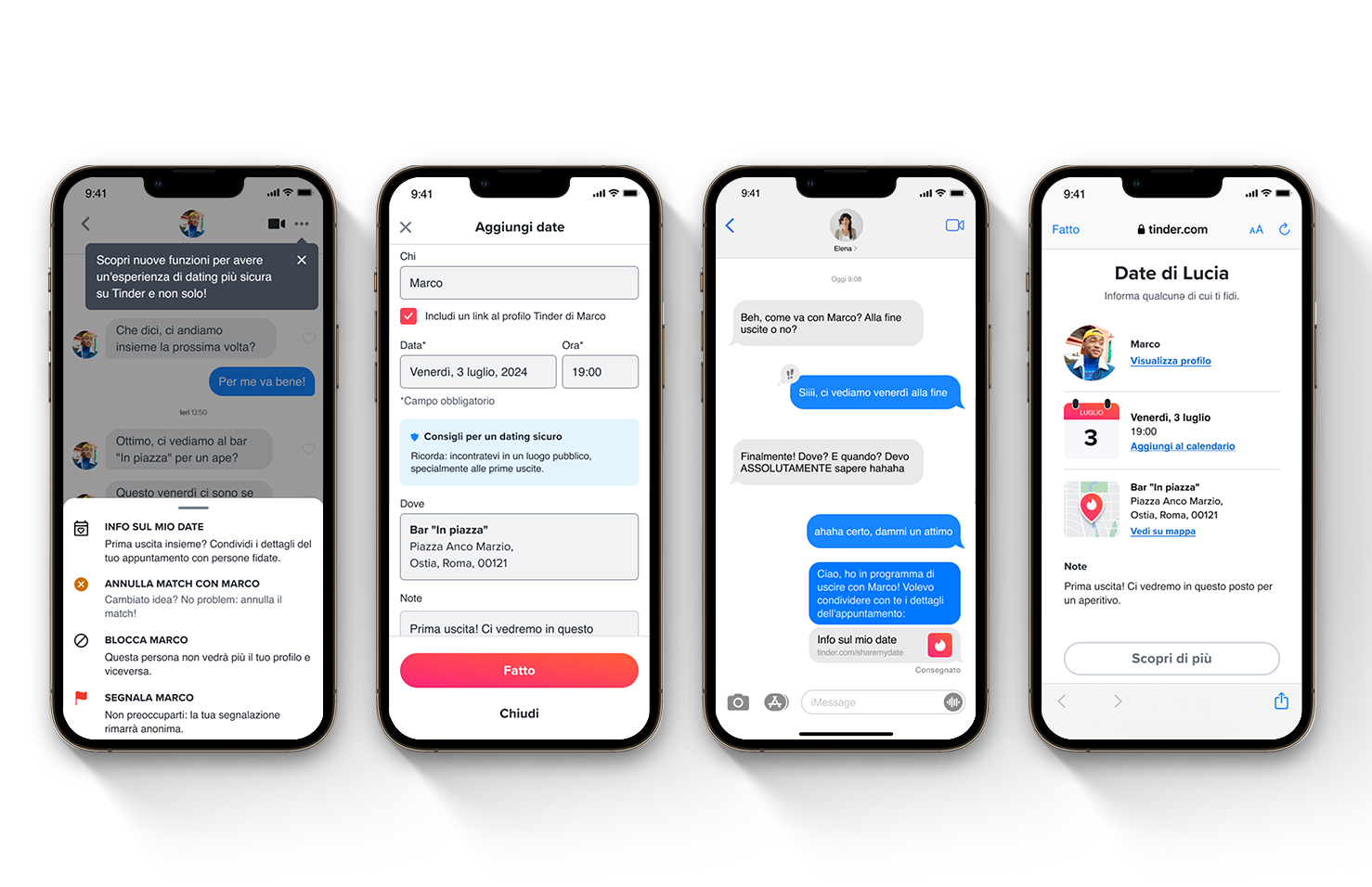

Tinder is introducing a new feature called “Share My Date” to make sharing date...

On Wednesday, French President Emmanuel Macron showcased his football skills by playing the full...