On Saturday, New Ulm baseball was victorious against Worthington. Luke Suess played a pivotal...

The first group of employees at Van Hool’s trailer division is expected to return...

On April 19, 2024, a pilot study published in the Journal of Neurosurgery: Spine...

A recent study by ACCA and IMA reveals that finance professionals are feeling optimistic...

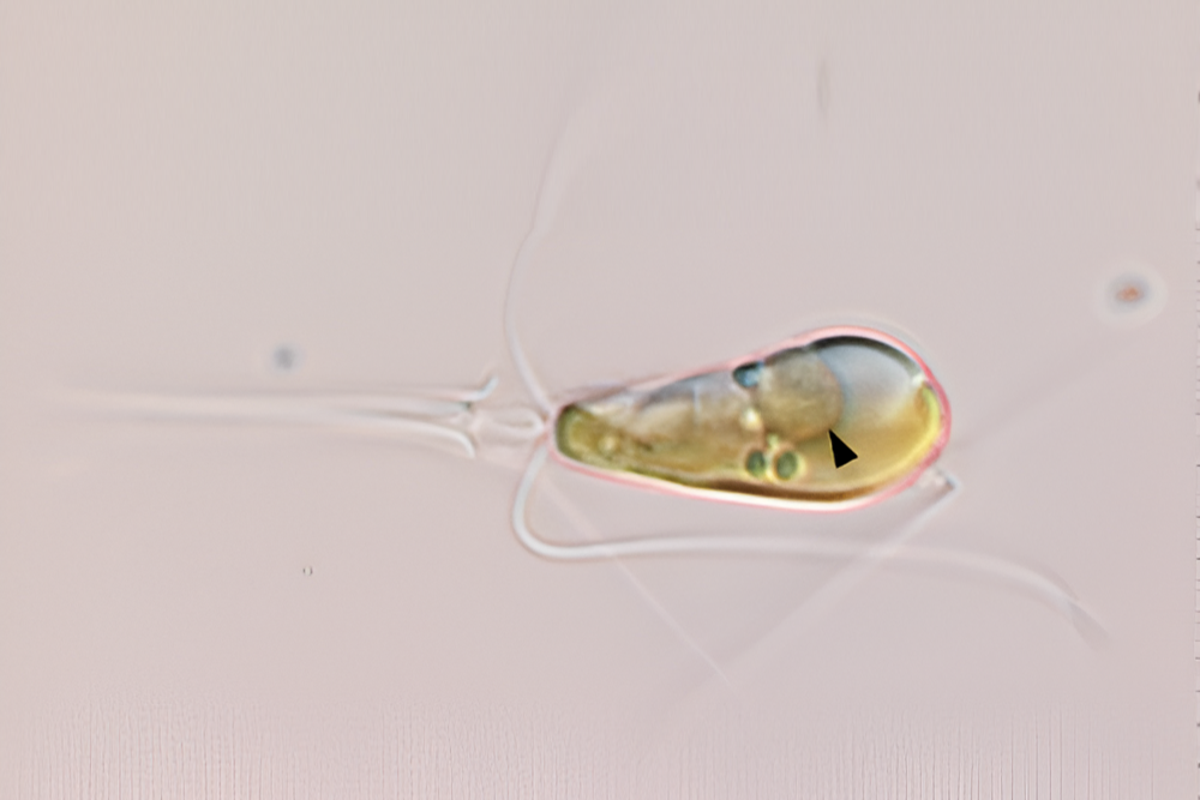

In a groundbreaking evolutionary event, two lifeforms have merged to form a single organism...

German politicians and business leaders are increasingly discussing a topic that was previously considered...

In the first quarter, LG Electronics’ TV business returned to profitability thanks to the...

In Miami Township, the use of drones has been a game changer in enhancing...

Licking Heights Local Schools has received an investment from the Governor’s Office of Workforce...

New Ulm Cathedral senior Kiah Helget had an impressive performance on the softball field...