On Wednesday, there was no update on the Mars Science Laboratory (MSL) rover’s activities...

On April 18, 2024, US Secretary of State Antony Blinken and Ukrainian Foreign Minister...

On Sol 1215, the Curiosity rover journeyed 67 meters towards its destination: the Namib...

Lubrizol is set to introduce LIPOFER microcapsules at Vitafoods Europe 2024. These advanced microcapsules...

On Sol 1089, we will be performing a range of activities on Mars. The...

During the recent international meeting of the International Monetary Fund (IMF) and the World...

The rise of Google Cloud is shaping Alphabet’s future in a significant way, with...

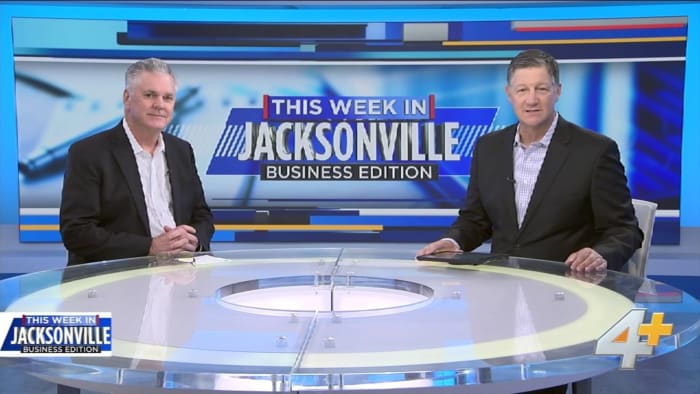

Eric Brown, Chief Innovation Officer at ManTech, and Mike Uster, the company’s CIO and...

Recently, Florida State College at Jacksonville introduced a driverless vehicle to transport students around...

Curiosity will be busy over the next few sols as it covers part of...