On April 14, 2024, the Elk Hills Oil Field in California showcased oil wells...

World Acceptance Corporation (NASDAQ:WRLD) will be hosting its fourth-quarter conference call on Thursday, May...

The Sherburne-Earlville athletic teams have officially changed their nickname to the Timberwolves, replacing the...

The Mississippi State Department of Health is bringing a touch of soul to its...

In the first quarter of this year, Nasdaq Inc. reported a decline in profit...

In 2024, six breweries from Minnesota stood out in the world of beer by...

On April 25, 2024, several notable individuals passed away. Lois Irene (Bastian) Barton, aged...

In the summer of 2024, Toronto will be visited by Foffy’s Wonderland, a unique...

Washington Commanders franchise legend Darrell Green will be honored with the retirement of his...

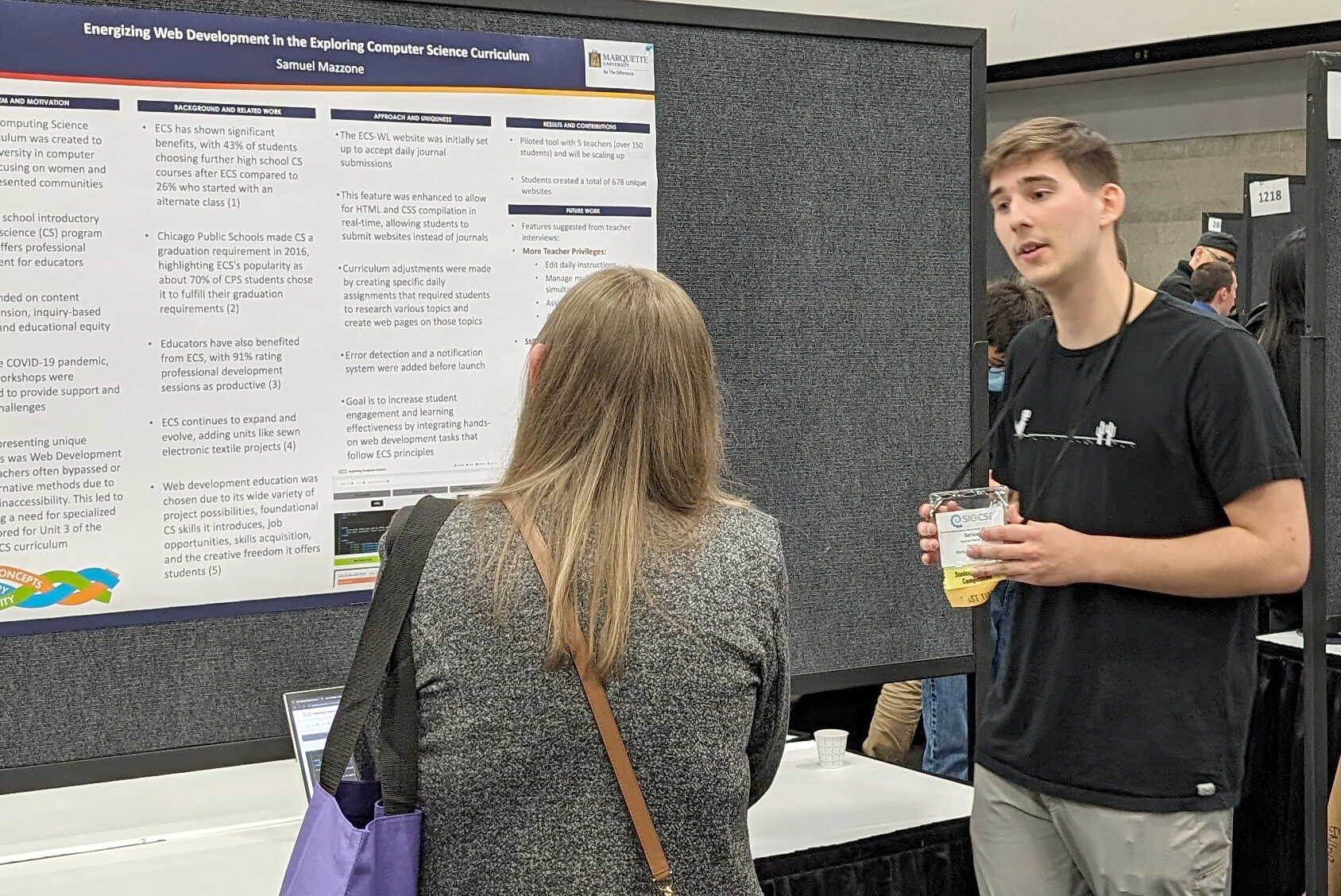

At the recent Association for Computing Machinery SIGCSE Technical Symposium on Computer Science Education...