At the 2024 Intercollegiate Broadcasting System convention in New York City, Mississippi State University’s...

Chris Calio, president and chief operating officer of RTX, announced during the company’s April...

Google and Samsung have announced that they will continue to work together to provide...

Vietnamese-based company Boviet Solar has announced plans to build its first North American solar...

On Wall Street, Alphabet’s share saw an almost 10 percent increase in value after...

As of April 26, a total of 28 border posts have been installed as...

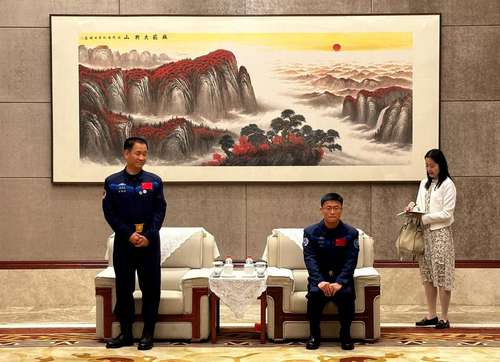

The Cooperation Forum Space Conference, which brought together representatives from China, Latin America, and...

The Los Angeles Chargers received trade requests for star quarterback Justin Herbert from the...

Savannah, Georgia- WTOC’s Dawn Baker was recently present at the 2024 prom celebration at...

International fund managers in Spain have witnessed a significant increase in the assets they...