What if you could bring your favorite anime character to life? This is not...

The aspiring nuclear physicist, Xu, was rejected by Nanjing University for failing to meet...

In California, former Boston Red Sox player and 2004 World Series winner Dave McCarty...

Despite the challenges, businesses in Narragansett, Rhode Island are still optimistic about the upcoming...

At the Wanda Diamond League meeting in Xiamen, Sweden’s pole vault star Mondo Duplantis...

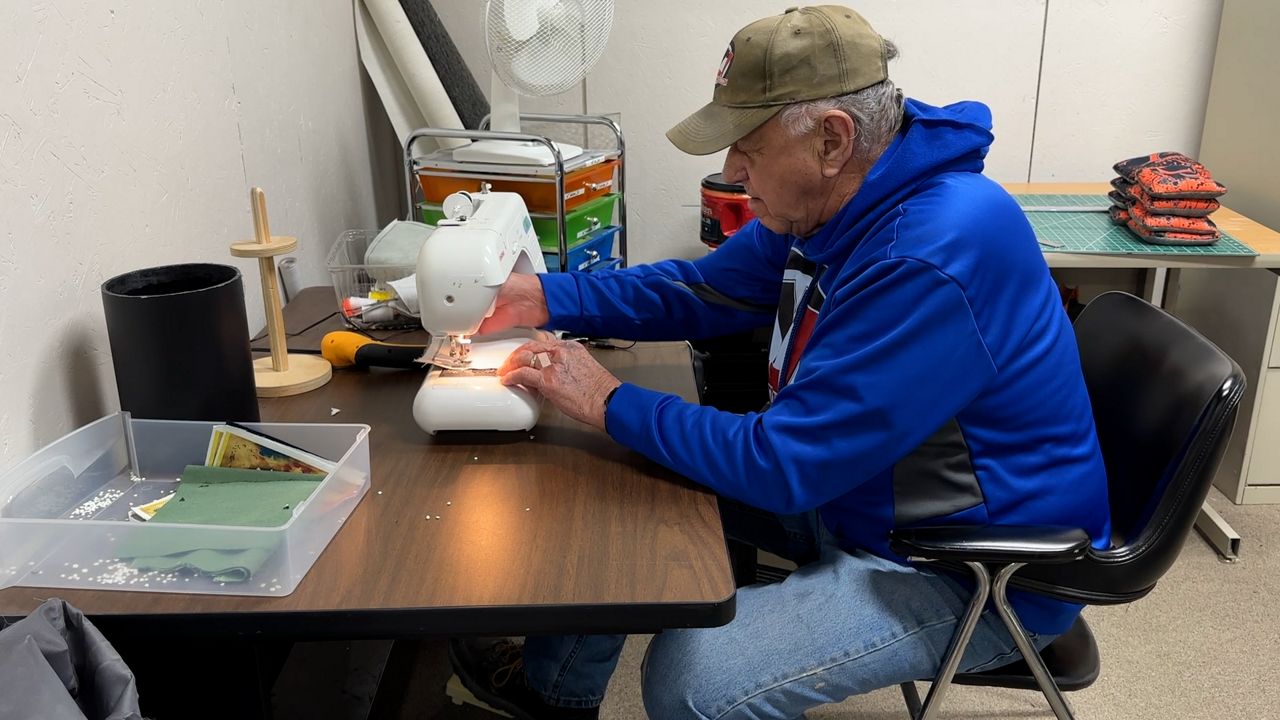

Skilled Cornhole is a family-owned business that focuses on handcrafting high-quality cornhole boards, bags,...

Elon Musk, the CEO of both Tesla and SpaceX, had plans to visit India...

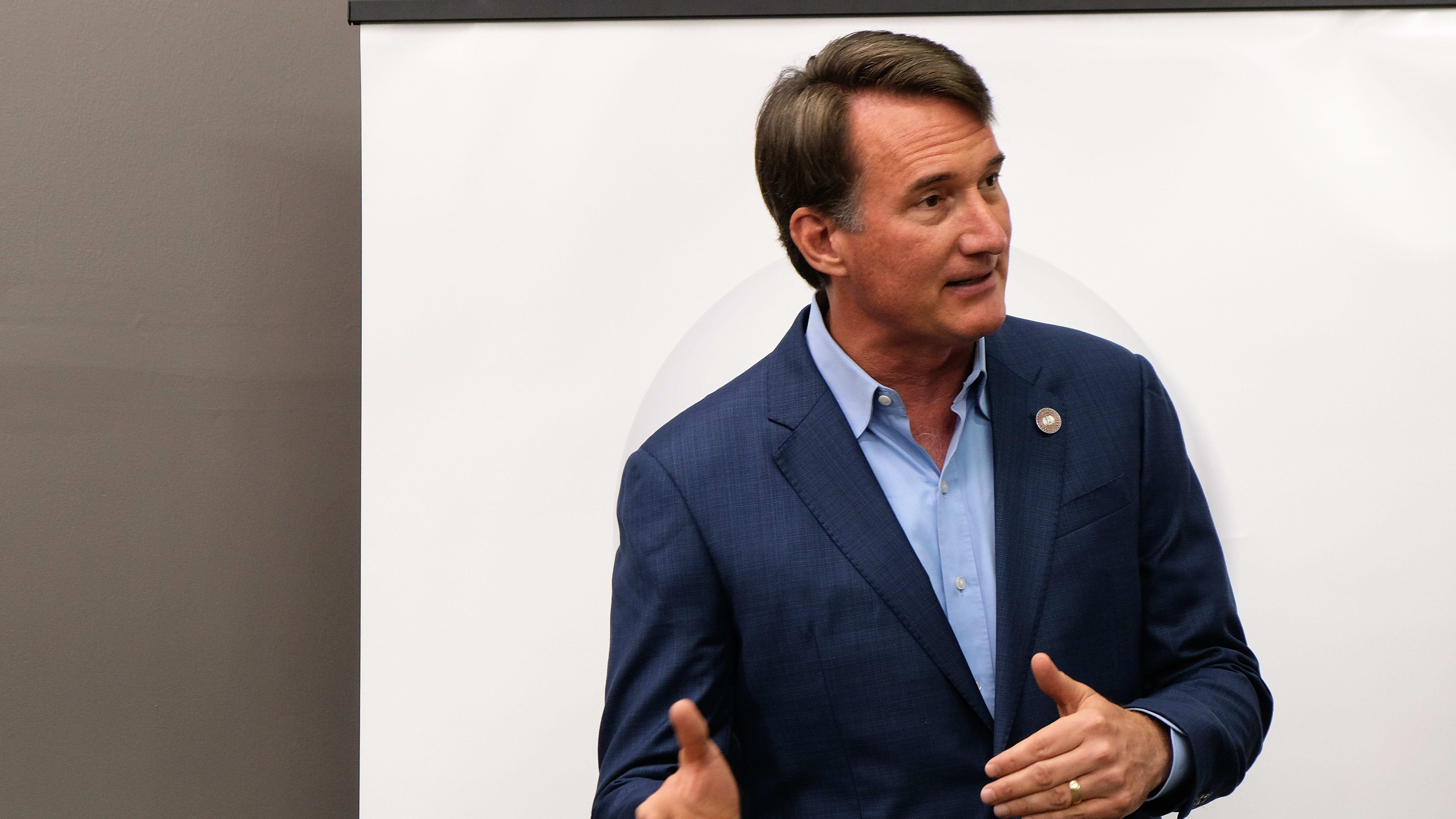

Governor Glenn Youngkin of Virginia recently signed a bill into law that will allow...

Armand “Mondo” Duplantis from Sweden put on a remarkable performance at the Xiamen Diamond...

Kate Middleton’s Recovery from Cancer: A Sign of the Royal Family’s Resilience In recent...

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/WHLUSLAHHRBUDAAQT3SMPCAUQU.jpg)