Evolution Equity Partners has received a $50.8 million commitment from British Patient Capital for...

Live Science is your one-stop shop for the latest discoveries, groundbreaking research, and fascinating...

The UK National Protective Security Authority (NPSA) has recognized the Israeli counter-drone company, Sentrycs,...

TSMC has announced its latest 1.6nm technology, A16, at the 2024 North America Technology...

The Xpeng G9 has recently caught the attention of many onlookers at a mall...

On Saturday, New Ulm baseball was victorious against Worthington. Luke Suess played a pivotal...

The first group of employees at Van Hool’s trailer division is expected to return...

On April 19, 2024, a pilot study published in the Journal of Neurosurgery: Spine...

A recent study by ACCA and IMA reveals that finance professionals are feeling optimistic...

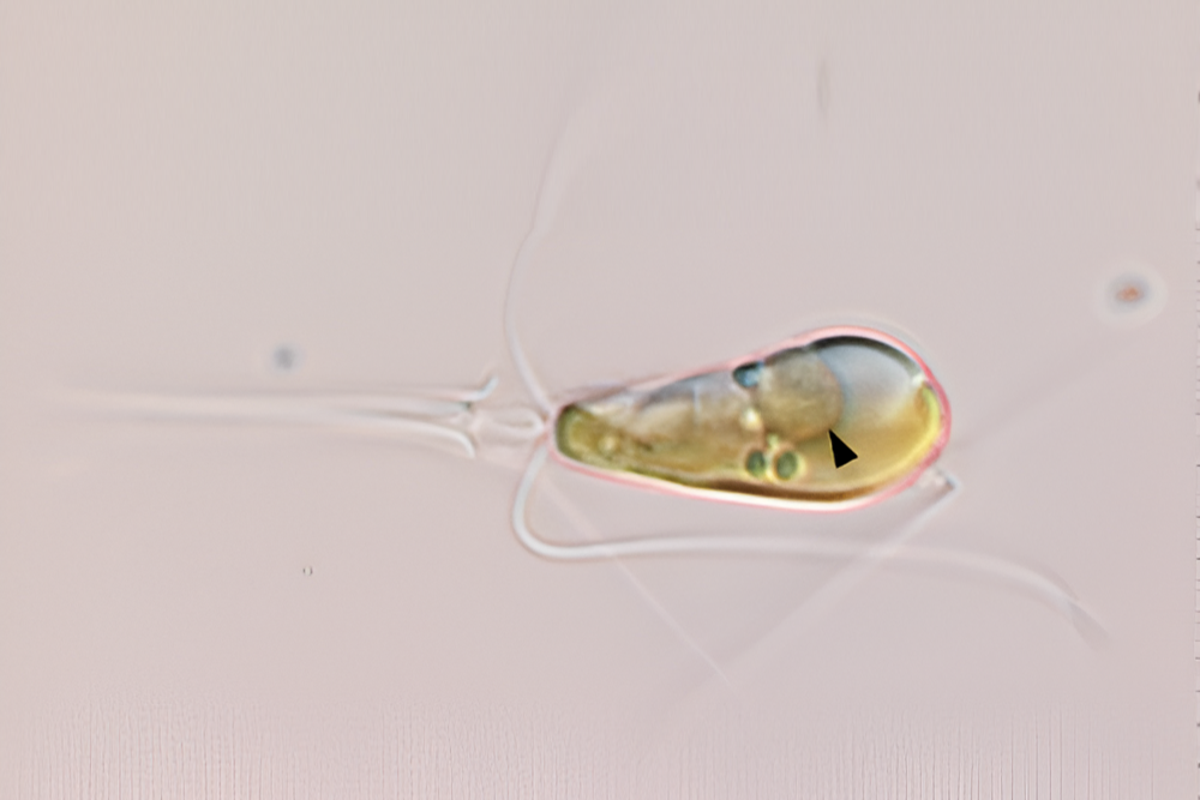

In a groundbreaking evolutionary event, two lifeforms have merged to form a single organism...