In May, the St. Mark Lutheran Church in Howard is hosting a free technology...

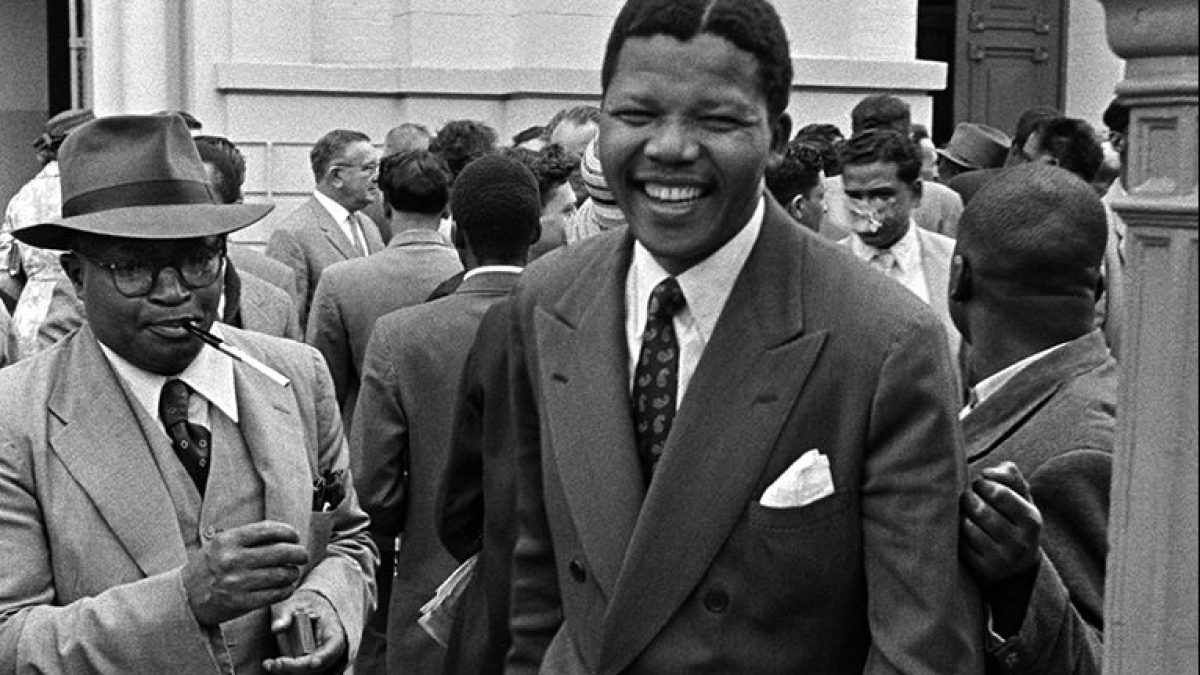

In 1948, apartheid was officially implemented in South Africa, a system of white supremacy,...

Envair Technology is the new name for the Envair and TCS brands, which have...

Downtown Bozeman is currently hosting its annual Restaurant Week, featuring over 25 local eateries...

According to research organization SINTEF, the aquaculture industry has a residual raw material utilization...

Intellectual property (IP) plays a critical role in advancing technologies that support the achievement...

According to a Reuters poll of 500 economists, the global economy is expected to...

High school students are being recognized for their positive impact on their teams, schools...

The Super Science Club received the Outstanding Club or Organization of the Year award...

Bexar County commissioners have approved a $5 million investment into the construction of a...