On Friday, the Helsinki Stock Exchange saw an increase in stock prices, with several...

Andrew Tate, a 37-year-old British influencer, has been charged with organized human trafficking and...

Two months have passed since the death of Akira Toriyama, a manga and video...

Novant Health has announced plans to enter the municipal bond market next week in...

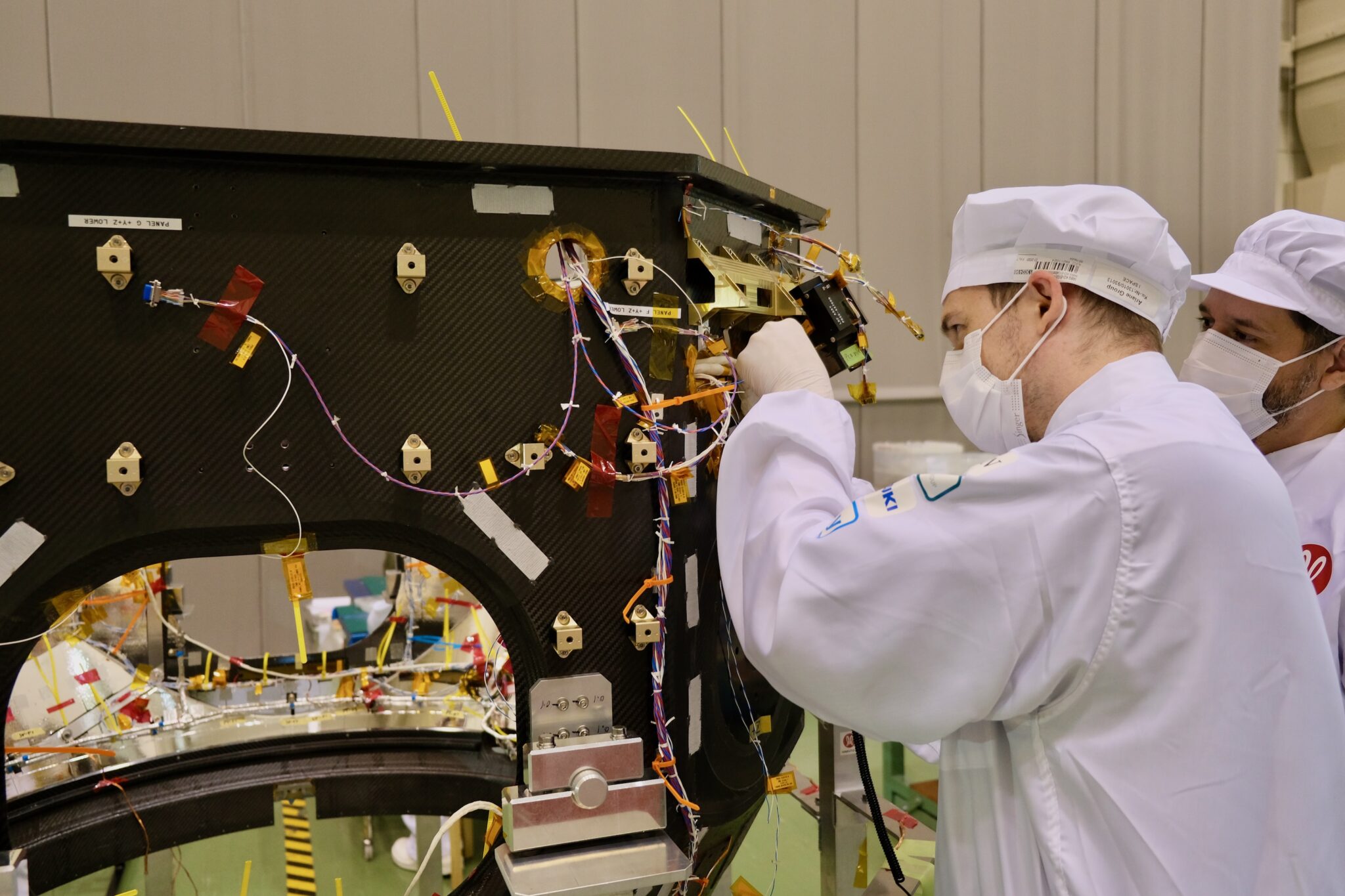

Ispace, a Japanese space company, has announced plans for a satellite communications system around...

As technology continues to play an increasingly important role in the operations of organizations,...

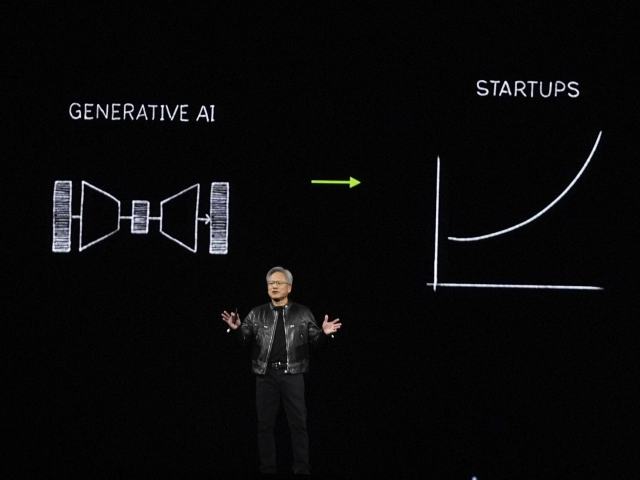

NVIDIA, a company known for developing chips for artificial intelligence technologies, recently made two...

On Friday, Israeli Prime Minister Benjamin Netanyahu made it clear that his government will...

Konami Digital Entertainment BV has achieved a significant milestone with 750 million downloads of...

Charles had been receiving treatment for an enlarged prostate since January, following the passing...

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/SD5YTFVAKZGDDLDDPQ4RVTNBJE.jpg)