A ribbon cutting ceremony and open house were held recently to celebrate the launch...

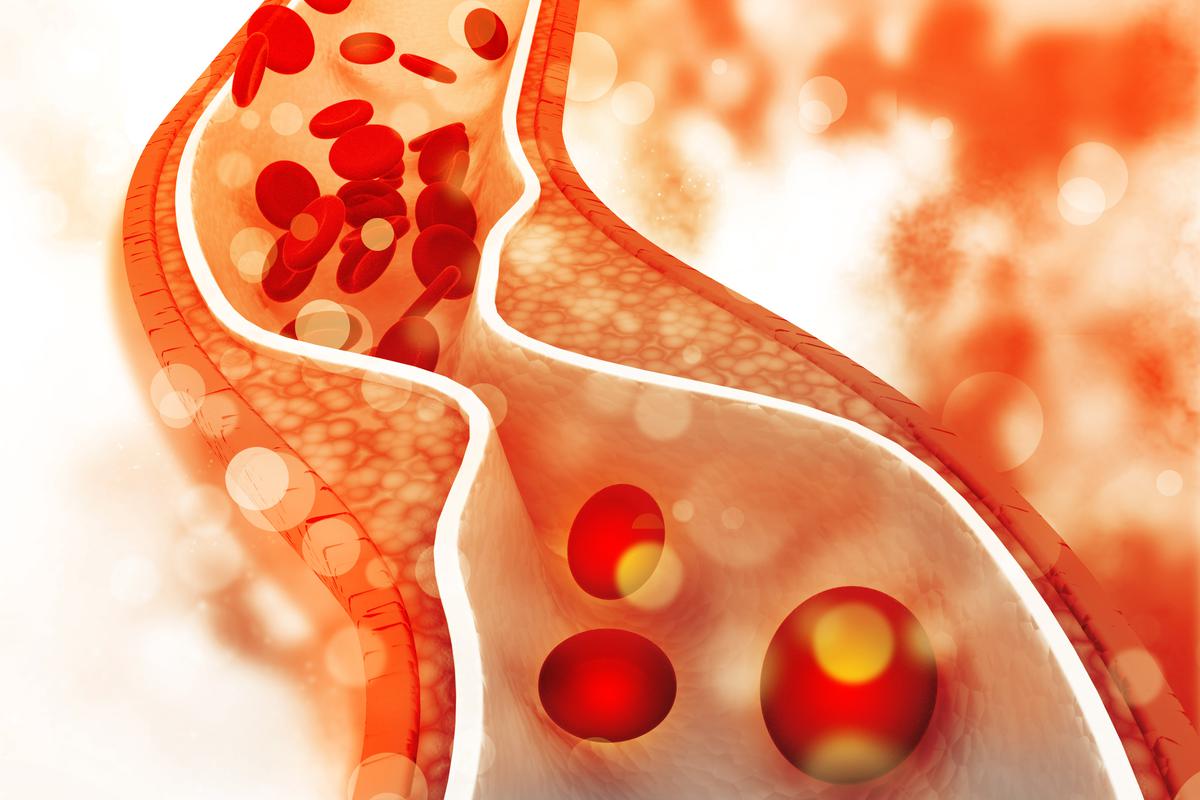

Cholesterol is a type of sterol, specifically a zoosterol found in animals, with the...

Jamestown’s Ella Propheter and her teammates celebrated their victory against West Seneca West during...

In 2023, a treatment facility proposal was rejected by Washington County officials. The Eaglecrest...

In this series, we delve deeper into DeLaval’s cutting-edge VMS Solutions Technology, commonly known...

Stanford University’s former president, John Hennessy, has been named the recipient of the prestigious...

In Bozeman, the Gallatin City-County Health Department (GCCHHD) ordered the closure of Dave’s Sushi...

In 2023, a treatment facility proposal for the Eaglecrest Recovery facility near Beaver Lake...

Join us for a special fireside chat on Universal Health Coverage (UHC) as we...

In the picturesque town of Bariloche, the Llao Llao Forum brings together influential businessmen...