This weekend, a health fair will be held in the Tulsa-metro area with a...

Butte College has just completed the construction of its new 72,276-square-foot science building. The...

Mark Zuckerberg has surpassed Elon Musk as the world’s third-richest person, with a fortune...

The $74.4bn iShares Core MSCI World UCITS ETF (EUNL) experienced a sudden 5% drop...

During his campaign tour in Pennsylvania, Joe Biden boasted about the strength of the...

The management at Seritage Growth Properties has decided to sell off its assets and...

On Saturday at 8:30 p.m. EDT, the Chicago Fire (2-3-3, 11th in the Eastern...

According to recent wage and inflation data, people are experiencing a gradual improvement in...

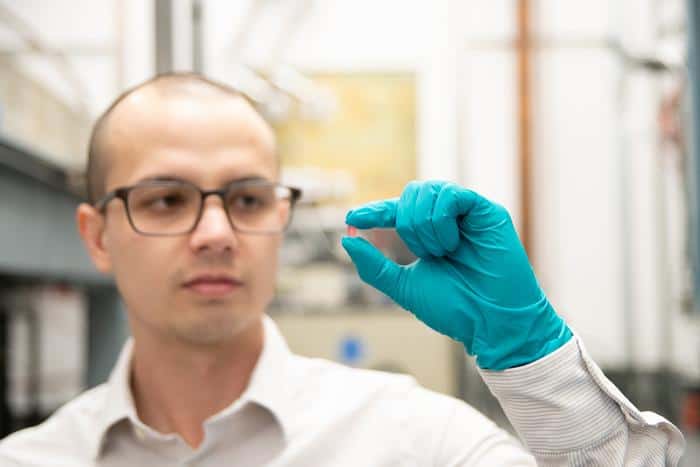

A team of researchers has made a significant discovery in the field of physics...

Six teachers in Wisconsin have been named finalists for the prestigious Presidential Awards for...