Giannis Antetokounmpo, the star forward of the Milwaukee Bucks, has been sidelined for Game...

As a father and husband in a family of five, I understand the financial...

As a journalist, I had the pleasure of interviewing Sue Loncar, who is bravely...

The FTC has recently approved a noncompete ban that could potentially revolutionize the health...

Rediance, a leading international sales agent based in China, has acquired the worldwide distribution...

Copyright © 2024, Arkansas Democrat-Gazette, Inc. All rights reserved. This document may not be...

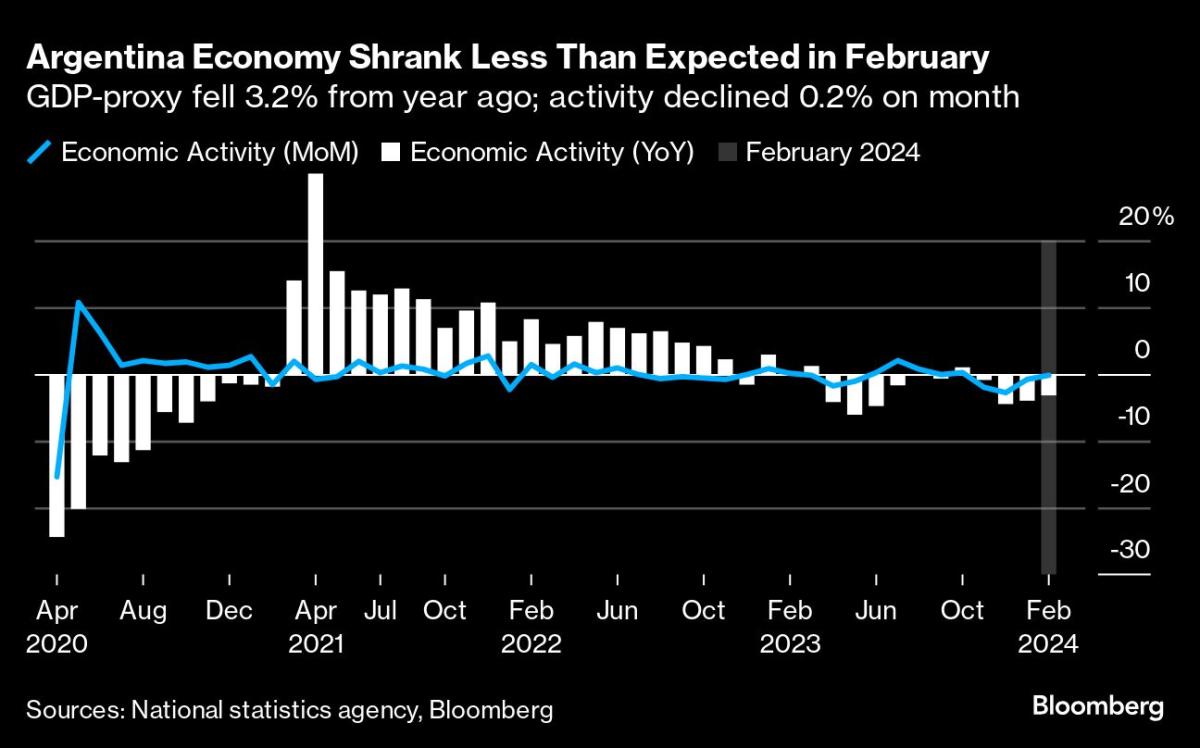

Argentina’s economy contracted by 3.2% in February compared to the previous year, despite President...

Pennsylvania Rep. Brian Fitzpatrick has successfully defended his seat in the GOP primary for...

On Tuesday, U.S. News and World Report released the 2024 edition of its “Best...

During a recent event hosted by the Economic Club of New York, JPMorgan Chase...