The first quarter of 2024 saw the U.S. economy experience a slowdown, with economic...

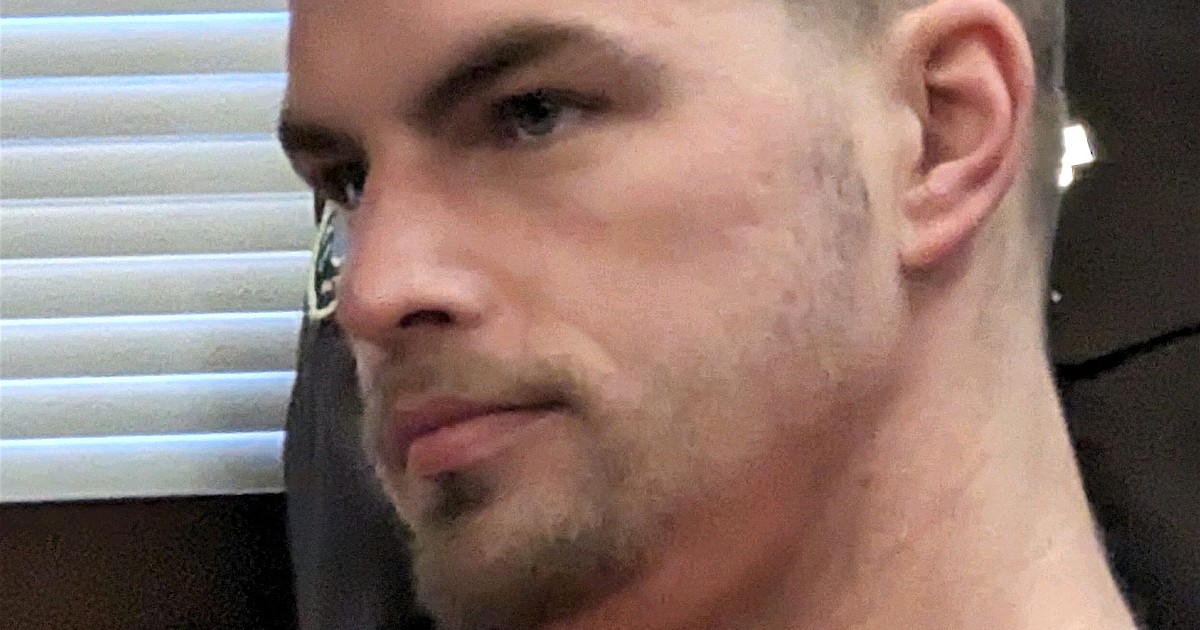

A Polson man, Bryce L. Morrison, 26, pleaded not guilty to a felony burglary...

On April 24, the China Manned Space Agency (CMSA) announced that two successful spacewalks...

The UVA market is being led by public and semi-public banks, with private banks...

Keep up to date with the latest news on the US economy by signing...

During a panel on leadership at the 2024 TIME 100 Summit, Tory Burch, the...

The H5N1 bird flu virus, which was first discovered in late March, caused concern...

Israeli cyber security company Check Point has reported strong financial results for the latest...

The Democratic Party is taking a deep breath after a tumultuous period. With the...

The University of Maryland has recently established a new institute dedicated to the development...